Markets Are Just People and Markets Are Relative, Not Absolute.

For the longest time, I thought of markets as some abstract, monolithic force—this giant system that exists out there beyond my reach. It felt like a black box, something you could only understand through complex analysis, industry reports, or whatever big companies were doing. Even worse… being in a Bschool turns it into something even more abstract, You’d think they exist in some separate realm, governed by formulas and theories rather than real people making decisions. We will also explore how Fix My Curls, a $6.81 million valuation brand, used principles explored in this article in its initial phase to grow a closely knit community.

Markets Are Just People

Strip away all the jargon, and business boils down to three simple things:

- A group of people with a shared problem or desire.

- A willingness to pay for a solution.

- The ability to reach them.

If one of these elements is missing, there is no market.

We overcomplicate markets We treat them like monolithic abstract forces, analyzing them through frameworks, reports, and endless data. But if you strip all that away, a market is just a person who needs something and is willing to pay for it.

Take a simple example: imagine you’re a potter in a village in the 1600s. Your “market” isn’t some vague economic entity—it’s just the people around you who need pots. If someone needs a pot and lives nearby, they’re your market. That’s it.

Even if you’re selling to a company, it’s not some faceless corporation—it’s still just a person inside that company who has a problem and needs a solution. Every market is just a collection of similar people with the same problem. Once you find one, you can find more. But the first step is realizing that markets are not abstract concepts.

They’re just people.

Markets Are Relative, Not Absolute

One of the biggest mindset shifts for me was realizing that markets are not universal—they are relative to who you are, what you can do, and what you can access. A market is only “good” in relation to you. If you can build something that people in that market need, and you have a way to reach them, then it’s a good market for you. But if you have the skills, don’t have access to enter that space, then for you, it doesn’t exist.

Think about it: a billion-dollar pharmaceutical company might see a cancer drug as a great market because they can afford clinical trials, regulatory approvals, and distribution. But for a solo entrepreneur, that market doesn’t exist—it’s completely inaccessible.

This is why asking “What’s a good market?” is the wrong question. The real question is: What is a good market for me, right now? If you’re trying to force yourself into a market that isn’t accessible to you, you’re making things unnecessarily hard.

Why Studying the Wrong Markets Won’t Teach You Anything

Another problem is to look at wrong things as a market case study. If you look at a laptop or mobile and try to figure out market you wont learn anything. Shit wont improve, its too big to not be influenced by emergence. Look for things with narrow application and Narrow target audience. Trying to reverse-engineer the market for something massive like laptops, iPhones, or Coca-Cola is useless. These are too big, too entrenched, and too influenced by emergent forces (network effects, brand legacy, global logistics, etc.)

Bad Case Study: Studying Apple’s iPhone Market

What you think you’ll learn: “How to sell premium products.”

What you’ll actually learn: Nothing useful. Apple’s market is shaped by:

- Massive distribution deals with telecoms.

- Brand loyalty built over decades.

- Luxury & lifestyle perception, not just functionality.

You can’t copy Apple’s playbook without billions of dollars and 30 years of momentum.

You should avoid studying mass-market products—they are influenced by forces too big to analyze meaningfully. Study markets where individual buyer behavior is clear and observable. And look at products that had to fight for every customer rather than relying on brand recognition.. Narrow markets show you first principles. A Chrome extension that grew to $10K MRR or a bootstrapped SaaS company that hit $1M without funding—these businesses reveal how markets actually behave. They show the real mechanics of identifying an audience, crafting an offer, and reaching them efficiently. These lessons are repeatable in a way that Apple’s success isn’t.

Making Market Recognition Intuitive

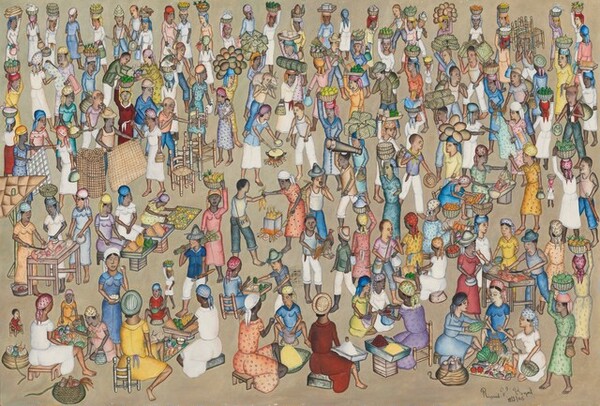

It helps to think of markets the same way people are categorized in daily life. It’s easy to recognize a gym bro, a finance geek, or a tech founder based on how they talk, act, and what they care about. The same intuition should apply to markets.

A useful mental exercise: look at any random person and ask, “What would I sell to them?” If something had to be sold in this instant, what would make them say yes? This forces a shift from thinking of markets as numbers in reports to seeing them as real, living audiences with needs, preferences, and spending habits. With this you will eventually learn to look at a product and work out who might actually be the ideal customer for it.

Once a pattern is recognized in one person, it scales. Finding that one person is non negotiable, everything else stacks on top of that. Find one, and the rest become easier to reach.

A relevant tweet

Case in Point : How Anshita Built a Market from Scratch

From zero customers to a $6.81 million valuation, Anshita Mehrotra’s Fix My Curls is proof that markets can be built through direct relationships with the right people. Today, her brand generates over $1 million in annual revenue, but its foundation wasn’t just about having the right product—it was about connecting personally with her Ideal Customer Profile (ICP) before launching. Growth through relentless direct engagement with the right people

Anshita directly engaged with her potential customers from day one. Instead of launching with ads or vague assumptions about demand, she cold DM’d individuals with curly hair, not to sell, but to start conversations. They were featured them on Fix My Curls’ page, and involved in shaping the brand—from product fragrances to names. This approach turned an early audience into an invested community, and by launch, she had personally interacted with 70 customers who came out of her first 500 followers.

Her journey aligns with the key insights of this article:

- Markets are just people. Anshita built Fix My Curls by talking to individuals, not treating the market as an abstract entity.

- Markets are relative. Instead of trying to compete in the broad haircare space, she focused on an engaged, underserved niche she could reach effectively.

- Direct connection accelerates market recognition. By embedding herself in her ICP’s world, she ensured demand before ever launching a product.

Fix My Curls success highlights a simple truth—finding a market isn’t just about analysis, it’s about interacting with the people who need you most and making them part of the journey. This article’s argument – that markets are fundamentally people with shared needs – is the very DNA of Fix My Curls’ rise. The company’s impressive metrics (from the $1.06M annual revenue and rapid growth to the successful $910K seed funding and $6.81M valuation) aren’t just numbers; they represent the tangible impact of Anshita’s empathetic, person-first approach. She didn’t chase ‘market’; she built genuine relationships.

Afterall, Markets Are Just People.

So it boils down to

Markets are not some abstract black box—they are just people with shared problems.

Instead of thinking about “finding a market,” think:

- Who already needs what I’m offering the most?

- Where do they naturally gather, looking for solutions like mine?

- Should I even bother dealing with whole group at this point and just reach one person at time?

- What message or trigger would make them say YES instantly?

The faster this shift happens, the easier everything becomes. Markets aren’t complicated—they’re just people, and business is just about finding them and solving their problems.